|

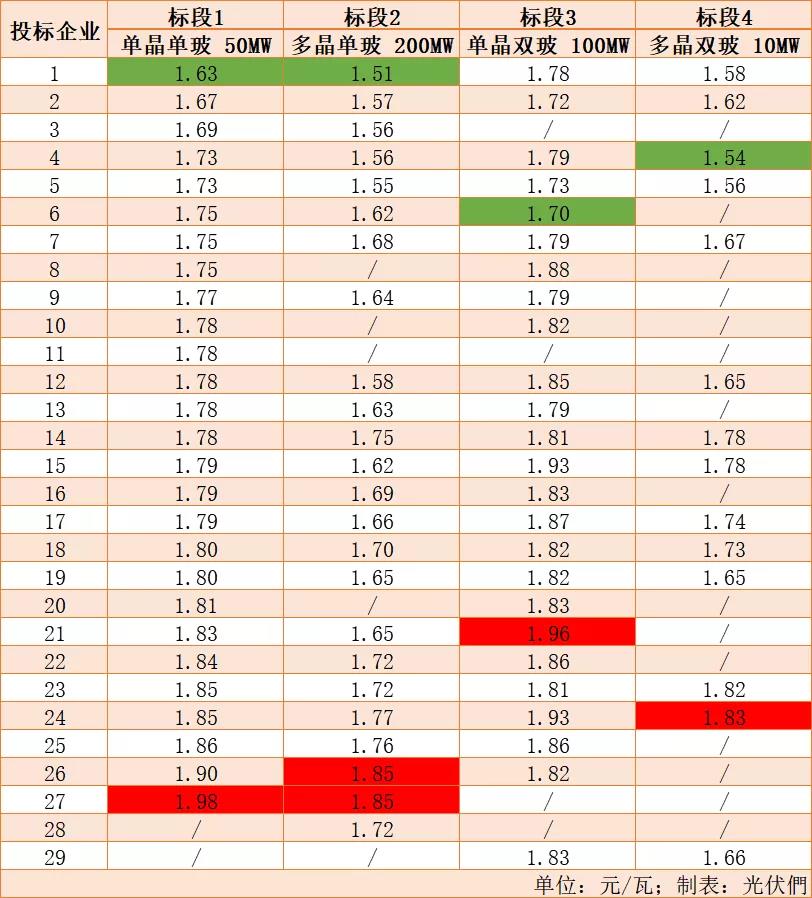

On November 12th, China can build a centralized procurement of PV modules in the first half of 2020. The total amount of bidding is 360MW, which is divided into four sections, including single crystal 50MW, polycrystalline 200MW, single crystal double glass 100MW, polycrystalline. Double glass 10MW. The opening price of each tender is as follows:

According to the bidding documents, the bidding is a framework agreement bidding. The projects are mainly distributed in Hebei, Shaanxi, Shandong and other countries, as well as Bangladesh, Uzbekistan and other countries. The bidding will determine that China can build a PV module winning supplier in the first half of 2020, winning the bid. The person signed a framework agreement with Zhongneng Construction, valid until June 30, 2020. Except for special circumstances, Zhongnengjian affiliated enterprises will purchase PV modules during the period. According to the specific needs of the project and the results of the bidding, the winning bidders will be selected and the procurement contract will be signed, and no separate bidding will be made.

According to the requirements of the bidding quotation in the bidding documents, the quotation is tax-included and freight-containing (within 2000 km). The bidding sections 1 and 2 shall be quoted according to the TPT backboard, and the bidding sections 3 and 4 shall be in accordance with the double-sided components ( Quote with aluminum frame). However, it should be noted that the bidding does not clearly specify the component power, so the bids of different bidding companies also differ greatly.

From the opening price, a total of 27 companies in the single-crystal bidding stage participated in the bidding. The lowest price was 1.63 yuan/watt, the highest price was 1.98 yuan/watt, and the average price was 1.787 yuan/watt. The main price was concentrated between 1.73~1.86 yuan/watt. . According to PV InfoLink's latest offer, the price of 315/375W single crystal PERC components is between 1.74~1.84 yuan/watt, and the average price is 1.77 yuan/watt. Most of the single crystal prices are basically the same as the market price.

In fact, the current ordinary single crystal components on the market have gradually been marginalized due to lower cost performance. The actual transaction volume has been significantly reduced compared with last year. Most of the single crystal production lines have been switched to PERC products. The mainstream power of single crystal products is basically 310. /315W or so. At the same time, as the domestic market in the second half of the year is far less than expected, the price of single-crystal PERC components has been steadily falling for several months. Recently, monocrystalline cells have returned to temperature, but there is still no sign of a stop on the component side. On the other hand, as prices continue to fall, market end customers have a wait-and-see attitude, hoping to lower the price of components.

It is worth mentioning that PVs have learned that the current order polarization of components is more serious, the orders of the first-tier manufacturers are full, the delivery pressure is relatively high, and even customers send representatives to the warehouse to pick up the goods, while the orders of the second and third-tier enterprises are not. saturation.

A total of 24 companies participated in the polycrystalline segment, with a minimum price of 1.51 yuan/watt, a maximum price of 1.85 yuan/watt, and an average price of 1.667 yuan/watt. The quotation of polycrystalline components is relatively scattered, and the quotations of different companies are quite different. Referring to PV InfoLink's latest offer, the current mainstream price of 275/330W polycrystalline components is between 1.6~1.7 yuan/watt, and the average price is 1.67 yuan/watt.

In fact, the price of polycrystalline monolithic supply chain has been chaotic in the near future. After the National Day holiday, the decline in the price of polycrystalline battery has been transmitted to the upper and lower ends of silicon wafers and components, including manufacturers, distributors and traders. At the end of the month, PVs understand that the first-line manufacturers are basically below 1.7 yuan / watt, the second-tier enterprises are below 1.6 yuan / watt, and the low price of 1.5 yuan / watt or even 1.35 yuan / watt does exist.

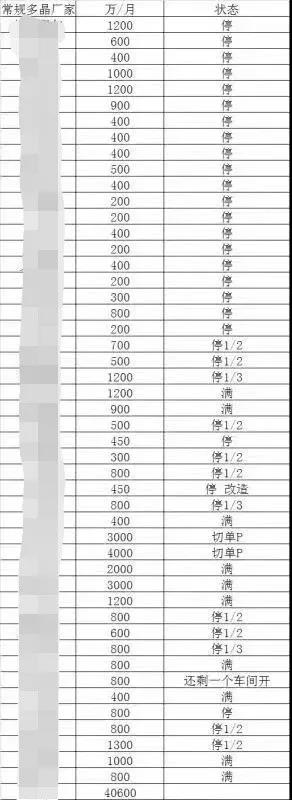

At present, the price of polycrystalline low has affected the operating rate of some ingot enterprises. The price of polycrystalline batteries has been lower than the cash cost of most of the production capacity. Some polycrystalline battery plants have switched to single crystals or shut down the production line directly. However, due to the poor demand for terminal polycrystals, the current price decline has not yet bottomed out. The stimulation of demand for price cuts will not be reflected in the short term, and the price of polycrystals will continue to be chaotic in the near future.

Note: The above picture shows the rate of shutdown of polycrystalline manufacturers by industry insiders. It has not been further verified and is for reference only.

In terms of double glass, a total of 25 companies participated in the single crystal double-glass segment, with a minimum price of 1.70 yuan/watt, the highest price of 1.96 yuan/watt, and an average price of 1.825 yuan/watt; a total of 14 companies participating in the polycrystalline double-glass segment, the lowest The price is 1.54 yuan / watt, the highest price is 1.83 yuan / watt, the average price is 1.86 yuan / watt.

Contrary to the price of the component of “falling down”, the price of photovoltaic glass has been firm and upward. In September, the market price of photovoltaic glass increased from 26.2 yuan/square meter to 28 yuan/square meter. At present, small factories in the industry have seen price increases. China National Building Materials has confirmed 3.2mm price increase to 29 yuan / square meter; in terms of big manufacturers, Xinyi Solar and Follett Glass are still at 28 yuan / square meter, and Xinyi Solar Energy Due to the strong demand for double glass, the price of 2.5mm glass increased by 1 yuan.

On the one hand, the growth in shipments of double-sided components has driven demand for photovoltaic glass. BNEF expects global double-sided component shipments to reach 20-29GW next year, accounting for 15-21% of total component shipments; Due to the large initial investment in the photovoltaic glass industry, the production capacity is relatively concentrated, and the industry barriers are high, the expansion period is long, and the supply increment is limited in the short term, which has led to the current high price of photovoltaic glass.

In summary, most of the bids are still in the market average, and the lower bids for each bid are breaking the new low despite the current price level, but the bidding time is in the first half of next year. This price is basically within expectations. From the beginning of the year, the price of single crystal PERC components has dropped from 2.25 yuan / watt to 1.77 yuan / watt, polycrystalline components decreased from 1.82 yuan / watt to 1.67 yuan / watt, a decline of 21%, 8.2%, respectively, by the domestic market demand Expected impact, component prices will still fall in the short term.

|